Solid-state battery technology is perpetually considered key to the next generation of electric and hybrid marine vessels. Leading developers explain the practicalities of this breakthrough tech, and look ahead to its future application.

Much like the EV industry, the marine sector’s efforts to decarbonize have depended on a series of technological milestones. Of the obstacles still to be overcome, the emergence and widespread application of solid-state battery technology has perhaps the greatest potential to mark a significant leap forward in electric and hybrid vessel capabilities.

“The primary challenge to broader application of electrification in the maritime industry has been the performance and safety limitations of more conventional lithium-ion storage technologies. For good reasons, safety requirements are already very stringent,” says Lavle CTO Ben Gully. “Up until now, electrification has largely been limited to vessels running shorter routes of 40 minutes or less, restricted by the energy density of existing cell technologies, and the size and weight of energy storage systems that can

be installed on vessels. Lithium-metal anode battery (LMB) and solid electrolyte battery (SEB) technology will enable vessel owners to overcome these barriers.”

“Next-generation Li-metal anode batteries, as well as Li-S, have the potential to significantly improve energy density at the cell level,” echoes Tomas Tengner, global product specialist, energy storage, for ABB Marine & Ports. “Some developments also show promise for a faster charge rate than is typical for current Li-ion battery technology.”

In marine applications, such a step forward could have obvious advantages.

“Ships could travel for longer in all-electric mode, for example, along longer ferry routes,” notes Henrik Helgesen, senior environmental consultant in the Environmental Advisory section of DNV GL – Maritime. “All-electric operation might also be more suitable for larger ships in maneuver mode close to shore and eco zones.”

While Helgesen does not believe solid-state batteries will enable all-electric operation for deep-sea vessels, he highlights the potential safety advantages of dispensing with liquid electrolyte solutions.

“They should not produce any explosive gases, and should be resistant to self-ignition – they can burn, however,” he explains. “It should, in theory, be much easier to install such batteries, with leaner ventilation and fire-suppression requirements.”

Because eliminating the flammable liquid electrolyte found in Li-ion batteries will relax thermal system requirements, battery system safety design can be greatly simplified, further increasing both gravimetric and volumetric energy density.

Challenges ahead

But a number of technological barriers remain before widespread uptake – and realization of solid-state benefits – can become feasible.

“There are three major challenge areas,” says Dr Joong Sun Park, solid state technical manager for Saft. “Solid-state electrolyte, chemical/mechanical interface, and scale-up/industrialization of production. The concept of solid-state battery technology is not really new, but the lower Li-ion conductivity in the solid form, as opposed to the liquid, hinders commercialization of the technology.”

There have been breakthroughs, however, with the development of solid materials that conduct ions at a similar – or even faster – rate than their liquid counterparts.

“These findings have revived development of solid-state batteries,” explains Park. “Still, some of these materials are not stable with lithium metal or at a high voltage, so designing a robust solution is still a challenge. Last, but not least, a company must have the capability to produce the technology on a large scale. In the short term, compatibility with existing Li-ion manufacturing equipment is necessary, but new manufacturing processes – dedicated to solid-state battery design, mixing and cell formation – need to be developed to deliver a cost-competitive product.”

“Another challenge that needs to be solved is the power conductivity [low C-rate] and the interface resistance between the electrodes and the electrolyte,” comments Helgesen. “The interface resistance is high since there is not a smooth surface between the electrode and the electrolyte. It also performs poorly in cold temperatures. In maritime applications, you need high energy and high power, so finding a solution that can match the C-rate of today’s liquid electrolyte batteries is certainly a challenge.”

“The mechanical stability is also a challenge,” adds Tengner. “Many of the high conductivity materials reported are brittle in nature. Parasitic side reactions also cause low Coulombic efficiencies, which lead

to short cycle lives.”

Indeed, Saft has built prototype batteries which Park believes show promise, but “cycle life of current solid-state batteries is not at the Saft-expected level of performance, so improving cycle life is one of the focus areas for our R&D.”

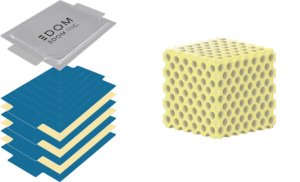

Lavle is working on LMB cells that, Gully explains, are made possible using technology from 3DOM – specifically the separator.

“This enables pathways to both SEB and LMB,” he says. “This allows Lavle to pack in more active material in a given amount of space, and a lot more energy in a battery cell package, which opens the door for the next generation of lithium-ion battery technology.

“We are opening up a whole new level of capability, and 3DOM’s technologies are providing new solutions which meet those objectives while also providing for the key factors of safety and cycle life.”

LMB and SEB technologies developed by Lavle have achieved double the energy density of leading current Li-ion solutions.

“We have demonstrated 420Wh/kg in full-size large-format battery cells currently cycling in the laboratory,” says Gully. “Also the lower operating temperature of Lavle’s LMB and SEB at 25°C ambient temperature delivers the safety characteristics necessary for broad commercial application, compared with competing battery solutions requiring elevated temperatures.”

This means that a Lavle system could potentially cut the size and weight of the battery in half for a given application – or provide double the amount of energy possible with existing Li-ion.

Shipping forecast

It is, however, tricky to predict what types of vessels might find a viable use for solid-state battery systems.

“Since we don’t know what performance the next-generation battery technologies will be able to achieve, it’s difficult to say whether they’ll be applicable for all vessel types,” says Tengner. “The first deployments will most likely be on vessels that require high energy densities while having relatively low battery cycle life requirements.”

“The high energy density delivered by solid-state technology will result in enhanced performance in electric and/or hybrid systems on a variety of vessels,” Park adds. “Sizing and scaling will depend on the needs of the vessel. If there is the footprint for battery installation, the technology can be leveraged to accommodate the electric and/or hybrid needs. It’s a win-win situation too. When installed, solid-state technology’s enhanced performance level is also able to deliver much enhanced safety for the vessel, crew, cargo and passengers.”

“In principle, any kind of vessel is suited for solid-state systems,” says Helgesen. “We expect greater widespread pure-battery solutions in the ferry and short-sea segment, and perhaps some use of hybrid applications in deep-sea shipping. Since solid-state solutions are not capable of handling high C-rates, they might need to be larger in kWh compared to liquid systems. So we might see some oversized solutions with regards to energy requirements for some ships. Then, it comes down to if you are willing to pay for an oversized energy solution.”

Much like other industries (see Common ground, page 37), the maritime sector can expect to enjoy a wealth of benefits with the adoption of solid-state battery technology. Just like those industries, however, major challenges remain in maturing the tech to the point of real-world application. But as the focus of research and development projects continues to tighten, the inevitability of solid-state solutions seems assured.

“Already, existing battery technologies can supply the power needed for ships operating over short distances, as well as serve as an additional power source for large ocean-going vessels,” explains Tengner. “Energy storage systems are widely considered one of the most promising solutions for decarbonization.”

Common ground

As with the development of Li-ion batteries, the marine industry faces many of the same issues as other sectors when it comes to the advancement of solid-state battery tech.

“In the battery world, maritime is a very small industry that consumes only 1% of the batteries,” says DNV GL’s Helgesen. “Research is mainly driven by consumer electronics, automotive and stationary systems. Automotive and consumer electronics are pushing toward maximum energy density at minimum cost, which makes the batteries useful for marine as well. So the marine industry really needs to pay attention to what is going on in the EV industry.“ (See From land to sea, page 52).

Stationary energy storage, by contrast, is pursuing advancements geared toward driving down price/kWh, which could yield solutions with lower energy density – making them less useful for marine applications. But that doesn’t mean that the two industries are mutually exclusive.

“Batteries used for peak shaving, and spinning reserve in maritime might not need to be as energy dense as EV batteries, if they are cheaper and safer,” says Helgesen. “So there might be some cell types developed for stationary systems that are suited for ships as well.”

Tide times

The question on every operator’s lips is when solid-state systems might begin appearing on the water. Understandably, experts working in this sector err on the side of caution when it comes to timescales.

“Due to some existing technical challenges, as well as the time required for industrialization and scaling up of new technology, we believe the first large-scale commercial applications for these battery technologies will emerge in about five years, and heavy-duty marine applications a few years after that,” says ABB’s Tengner.

Helgesen opts for “three-to-five years” and Saft’s Park tends toward ballpark figures with regards to widespread uptake.

“Saft will first introduce the technology to early adopters for special low-volume applications such as defense, space and aviation within the next three years,” says Park. “In parallel, we will continue to mature the technology in energy, packaging, performance and cost, to accommodate segments such as commercial, military and maritime.”

Lavle’s large-format LMB and SEB energy storage systems are currently in prototype testing, and the company is preparing mass-production facilities for the next-gen cells in the USA.