Following consultation with IMO member nations and other stakeholders, the World Shipping Council (WSC) has further developed the Green Balance Mechanism, a regulatory measure designed to ensure that shipping meets its net-zero goal by 2050 in an efficient, just and equitable way.

A detailed proposal, including design updates and regulatory text for the Green Balance Mechanism, has been submitted to support the timely development of effective climate regulations for shipping at the IMO ISWG-GHG 17 and MEPC 82 meetings.

Affording green fuel

According to the organization, over 60% of new container and vehicle carrier vessels for delivery by 2030 will be ready to use the greenest fuels. However, these fuels are scarce and several times more expensive than fossil fuels, the WSC says. Its Green Balance Mechanism aims to bridge the price gap, making green fuels competitive with fossil fuels. Fully integrated with a technical fuel standard, the Green Balance Mechanism allocates funds collected from higher greenhouse gas-intensity fuels to lower GHG-intensity fuels, enabling carriers to operate competitively on green fuels, ensuring demand that will drive investment in green energy and fuel production.

Joe Kramek, president and CEO of the WSC, commented, “For shipping’s energy transition to take place, green maritime fuels must be available at scale, requiring billion-dollar investments by energy producers. For these investments to occur, the IMO must adopt regulations that not only increase fossil fuel prices but also make green fuels a viable alternative. Only then will there be a strong enough market for green maritime fuels to stimulate the necessary levels of investment in green fuel production and renewable energy.”

How the Green Balance Mechanism works

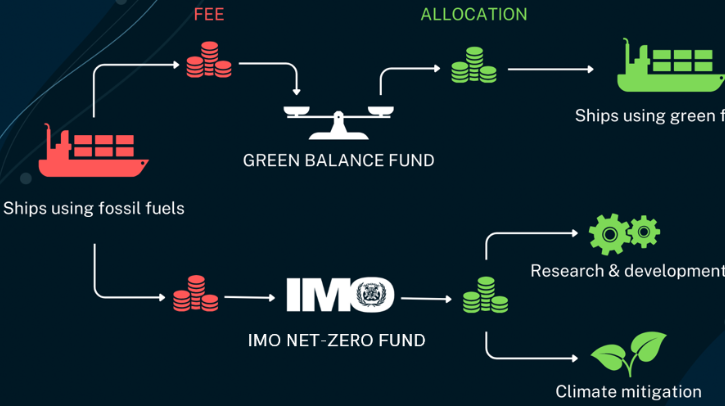

The Green Balance Mechanism is fully integrated with a greenhouse gas fuel-intensity standard. It applies a fee on fossil fuels and then allocates the funds to green fuels so that the average cost of fuel is roughly equal. The fees and allocation of funds are calculated each year, based on the amount of green fuel use and market prices, balancing out the cost across very different fuels. The greater the greenhouse gas emission reductions a fuel delivers – on a well-to-wake lifecycle basis – the greater the financial allocation received.

This is intended to accelerate the uptake of the greenest fuels, delivering the deepest greenhouse gas reductions. At the same time, all fuels that deliver greenhouse gas reductions above the standards established in the Green Balance Mechanism receive some allocation, proportional to their greenhouse gas emission reduction. The emissions reductions required for fuel to receive an allocation would follow the IMO commitments to decarbonization over time, starting at a reduction of 65% compared to fossil fuels and increasing in stringency to reach the 2050 net-zero goal. The Green Balance Mechanism includes a framework to create a parallel ‘IMO Net-Zero Fund’ to raise funds for research, development and demonstration projects and climate mitigation initiatives, to provide a just and equitable transition.

The Green Balance Mechanism has been designed to encourage immediate investment in the greenest fuels and technologies, jump-starting the energy transition in a cost-efficient manner. It provides incentives for fuel producers and shipowners to invest in advanced technologies now, avoiding costly incremental changes.

Kramek said, “IMO member states have a unique opportunity to decarbonize the world’s ocean supply chains. We do not have time for half-measures. The IMO’s regulations must make it possible for green fuels to compete with fossil fuels, to drive the transition effectively. Anything less risks raising transportation costs without achieving the climate progress the world needs.”

In related news, Wärtsilä recently launched a report that has found that sustainable shipping fuels could reach cost parity with fossil fuels as early as 2035 with the help of decisive emissions policy such as carbon taxes and emissions limits. Click here to read the full story.